Subscribe

Stay in the know

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

Open banking continues to transform the world of finance, enabling seamless integration between banks, third-party providers (TPPs), and consumers.

The regulatory frameworks that underpin the rollout of open banking across Europe, such as the EU’s Revised Payment Services Directive (PSD2), have driven steady growth in open banking in France. However, despite this momentum, some challenges remain, particularly those related to consumer trust, data security, and interoperability with financial institutions.

That being said, recent reports show open banking and real-time payments in France are about to undergo a period of significant transformation.

In this blog post, we look at payment preferences in France, trends driving payment behaviour, progress in open banking, and some of the major challenges influencing its development in the French market.

France is known for its diverse payment landscape, which combines traditional and digital payment methods. Cash and cards coexist with more recent digital payment methods, driven by consumer preferences, government policies, and technological advancements.

Despite a steady decline in its use, cash remained the most widely used form of payment at points of sale in France in 2022, accounting for 50% of transaction volumes, down from 68% in 2016. However, as payments become more digitised, its popularity will inevitably decline further. Following the pandemic, the majority of French consumers now prefer contactless card payments. Increased contactless limits—currently set at €50—have further improved the convenience of card payments.

For online payments, credit and debit cards continue to dominate. According to a report by the Banque de France, card payments made up 56% of non-cash transactions in the second half of 2023. France’s national interbank network, Cartes Bancaires (CB), issues 95% of the credit cards in France, which are co-branded with Visa or Mastercard.

Mobile payments have steadily grown in popularity as services like Apple Pay, Google Pay, and Samsung Pay become more widely accepted. A recent Statista survey revealed that 11% of French consumers used smartphone payments for everyday purchases in the past 12 months. Fintech apps like Lydia and Nickel are transforming how consumers manage payments. Lydia, sometimes called “the French Venmo,” has more than 8 million users and enables online payments, bill splitting, and peer-to-peer transfers. These mobile-first platforms are becoming central to daily financial transactions, particularly among younger generations.

The landscape of payments in France is influenced by both consumer preferences and technological developments. In recent years, a few significant trends have emerged:

Instant payment systems, such as SEPA Instant Credit Transfer (SCT Inst), have grown significantly. Because transactions are completed in a matter of seconds, the service expedites payments for both consumers and businesses. By mid-2023, 53% of all SEPA payments in France were made through SCT Inst., according to the European Payments Council, indicating the technology’s growing popularity.

ACI Worldwide’s Prime Time for Real Time report, 2024, further illustrates the rise in instant payments in France:

The Buy Now, Pay Later trend is becoming more popular, especially among younger consumers. Deferred payment options—offered by companies like Klarna and Alma—allow customers to break up the cost of large purchases into smaller instalments. This trend is particularly appealing for online shopping and is expected to expand as French e-commerce continues to grow.

While still niche, there is a growing interest in cryptocurrency payments in France. Major retailers like Decathlon and Sephora have started accepting Bitcoin in selected locations through partnerships with cryptocurrency service providers. While cryptocurrency adoption is relatively small, it’s an area that could evolve as regulation and infrastructure mature.

The PSD2 directive, which requires banks to open their payment services and data to licensed TPPs (like Yaspa) with customer consent, has had the greatest impact on France’s open banking landscape since it came into force in January 2018. Fintechs and neobanks are gaining market share as a result, making the financial ecosystem more competitive.

The adoption of open banking in France has been steady but cautious. As of 2023, France has an 8.5% adoption rate for open banking services, expected to rise to 36% by 2027, according to Mastercard. Large banks, such as BNP Paribas and Société Générale, have begun offering API services that allow fintechs to integrate with their platforms, enabling a range of new services, from instant payments and budgeting tools, to streamlined lending processes. Though penetration of real-time payments remains low in France compared to its EU counterparts, legislation announced by the European Parliament in February 2024 will soon accelerate its adoption. The legislation will impose a top-down mandate on all banks within the Eurozone to offer their customers instant payments (10 seconds or less) 24/7.

France has seen a number of homegrown fintech companies lead the way in open banking innovation, including Qonto, Linxo, and Bankin’. These platforms use bank APIs to provide value-added services using open banking technology, like credit comparisons, business expense tracking, and personal finance management. For example, Qonto has customised its services to cater exclusively to freelancers and SMEs, an underserved market segment in the past.

Banks have recognised the importance of APIs in fostering open banking partnerships. For example, Société Générale introduced an open innovation platform that lets programmers design and evaluate applications using actual banking data. These partnerships between fintech companies and traditional banks are essential to improving user experiences and developing cutting-edge financial products.

While open banking presents numerous opportunities, it also faces significant challenges in the French market. These challenges include consumer worries about cybersecurity and data privacy, as well as regulatory complexities.

Though some scepticism about data sharing exists, the enforcement of rigorous GDPR rules offers a strong basis for fostering customer confidence in open banking. Leveraging the GDPR’s focus on data protection can help to show a commitment to transparency and security. Awareness and educational campaigns by banks, fintechs, and regulators will be crucial for increasing consumer awareness and engagement with these services.

France’s financial regulators, such as the Autorité de Contrôle Prudentiel et de Résolution (ACPR) have been proactive in implementing PSD2. But different interpretations of the regulations by banks and TPPs create obstacles to the standardisation of APIs meaning the user experience of someone accessing payment services powered by open banking can vary depending on who they bank with. However, the implementation of the STET API in France, a basic API standard for open banking, is a promising start. It is provided by the Systèmes technologiques d’échange et de traitement (STET) clearing house for retail payments. While many other European countries have struggled to achieve standardisation across open banking APIs, the STET API gives France an initial edge as it provides a standard user experience for users making retail payments using open banking, and will hopefully pave the way for the standardisation of real-time payment services in other sectors across France.

While there has been some progress in the standardisation of API frameworks across Europe thanks to initiatives like the Berlin Group, and the STET API in France, more work is still needed to guarantee interoperability throughout the French financial ecosystem. Additionally, the lack of standardisation leads to IBANs being treated differently, triggering extra steps and friction in France where some banks require users to enable an ‘International payments’ in-app setting to connect their bank using open banking.

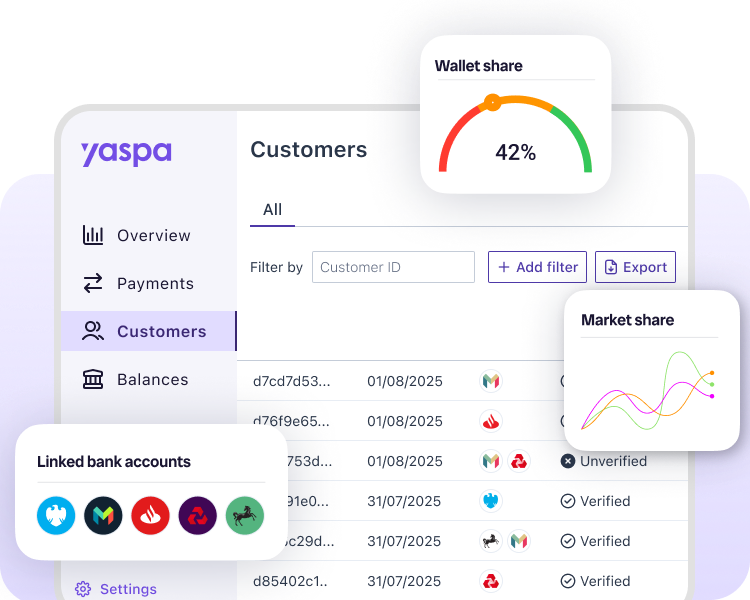

Yaspa is at the cutting edge of open banking solutions and we are proactive in addressing country-specific open banking challenges as already discussed. For example, to overcome the IBAN issue in France, we’ve introduced pop-ups that warn users in advance and direct them to banks with a higher conversion rate, one that guarantees a more seamless experience and instant settlement.

While open banking use in France is currently low, the future looks bright with 36% adoption projected by 2027. Consumer awareness is also inching up. Although only 4% of the population had heard of open banking according to Mastercard’s report, the STET API may mean this is because consumers take connectivity for granted and are already, unknowingly, using open banking services and more accustomed to its benefits than they realise.

With the introduction of PSD3 and the mandate for instant payments, this position is set to be strengthened even further. These regulations prioritise consumer protection and encourage TPPs to develop innovative solutions that directly address these needs.

Yaspa offers a wide range of services, including:

If you’re interested in learning more about what Yaspa can do for your business, do get in touch. We would love to hear from you.

Subscribe

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

"*" indicates required fields