Features

Simple set-up for stress-free scale

Total control, one API call away

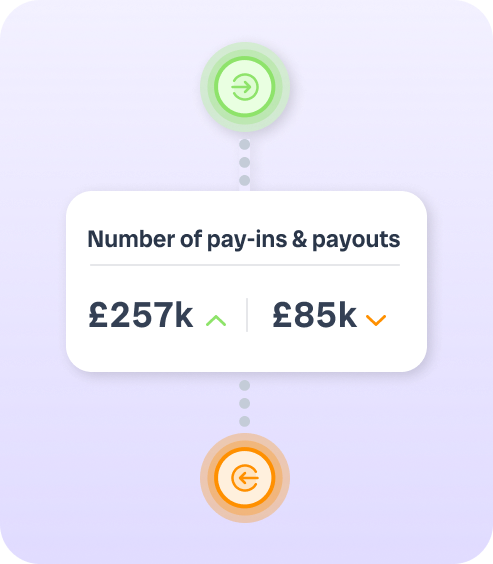

Real-time visibility on every transaction

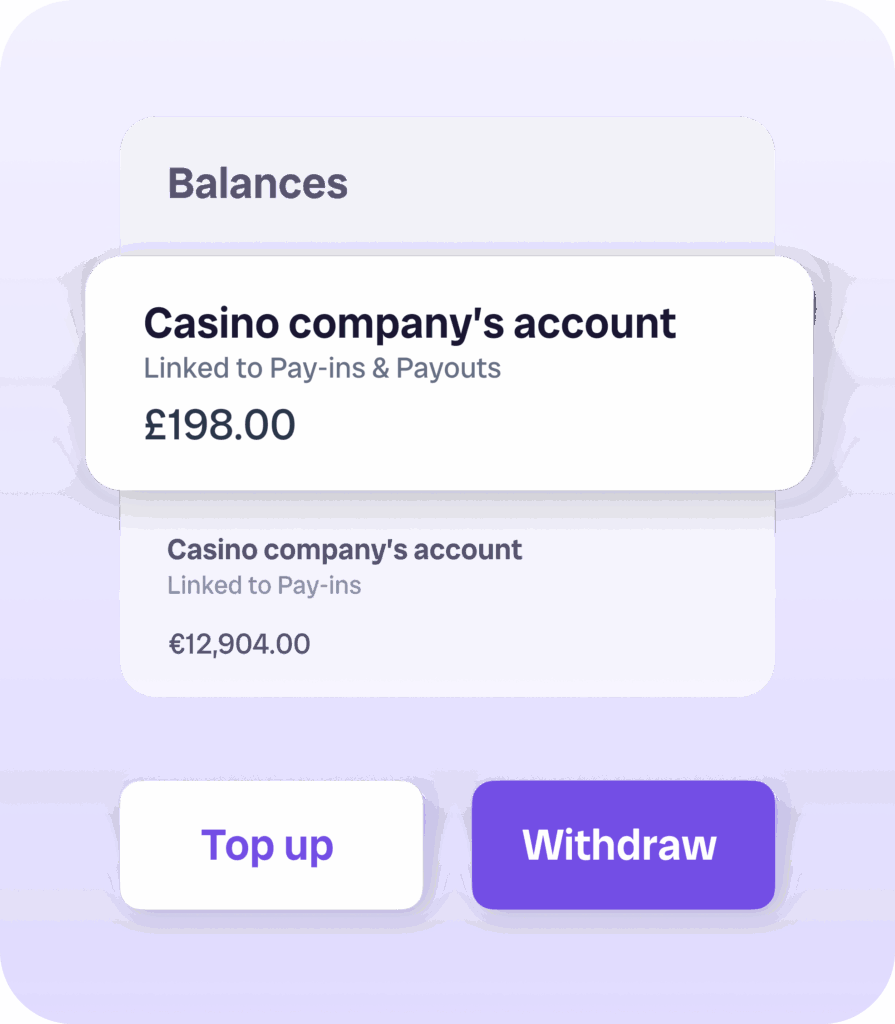

Accounts to fit your business

Max Collinge

Head of Payments at Yaspa

“With Yaspa, merchants can easily open e-money accounts (vIBANs) in Europe and the UK to receive and send instant payments. Our financial infrastructure allow customers to automate their sweeping and reconciliation processes in real time.”

Our products

Payments that flex to fit your world

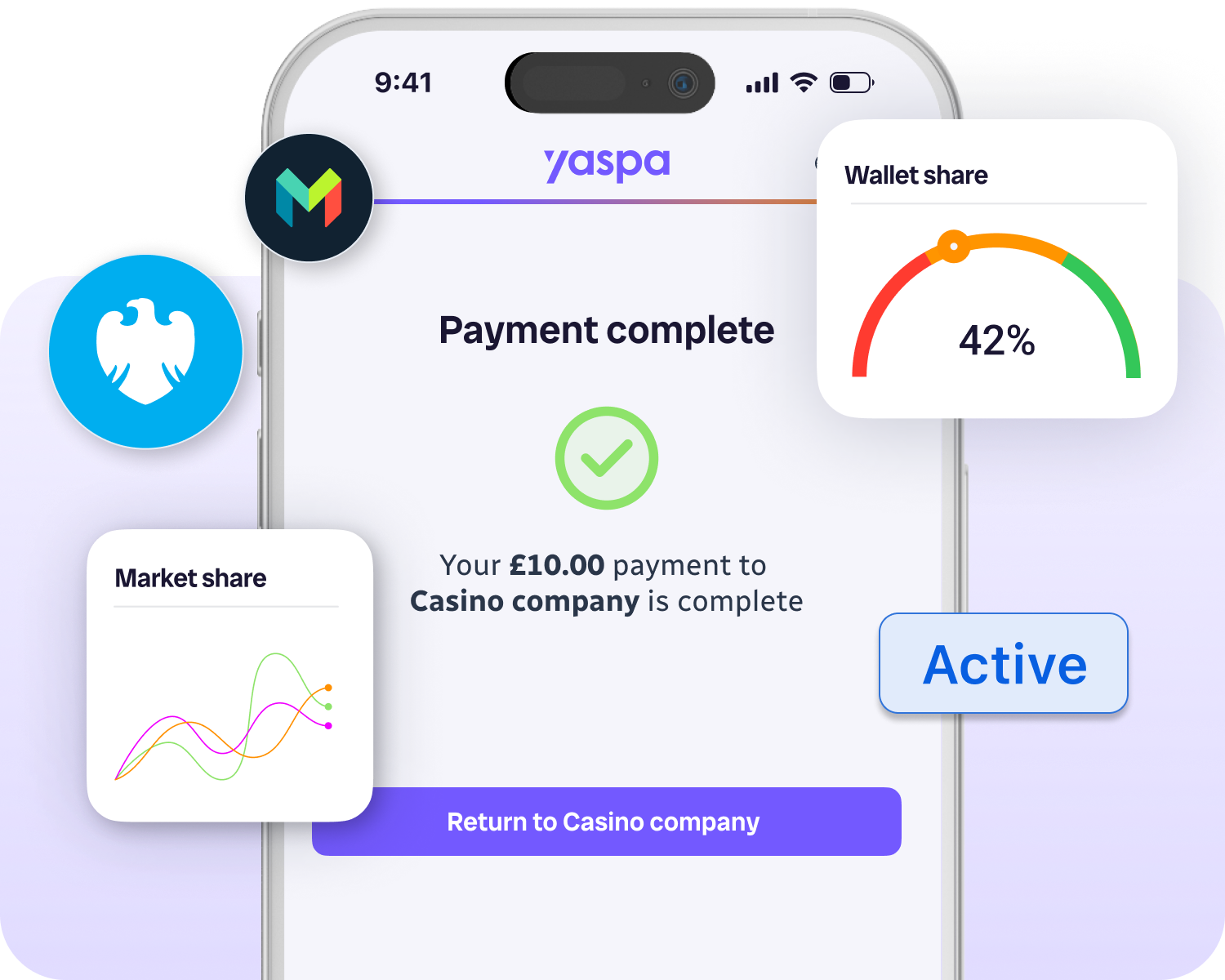

Real-time identity, risk, and insight in every payment

More than just fast. Yaspa’s Intelligent Payments turn every transaction into real-time insights, linking identity, risk signals, and behavioural data. This means safer payments, smarter decisions, and faster growth.

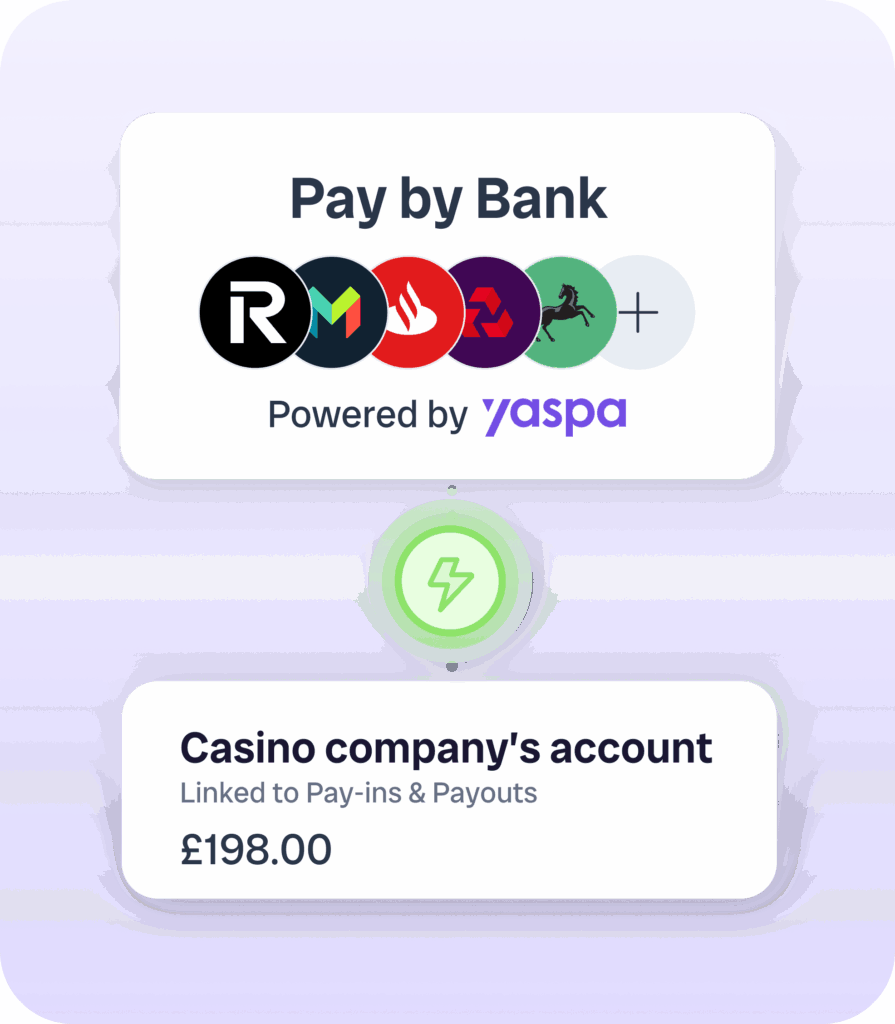

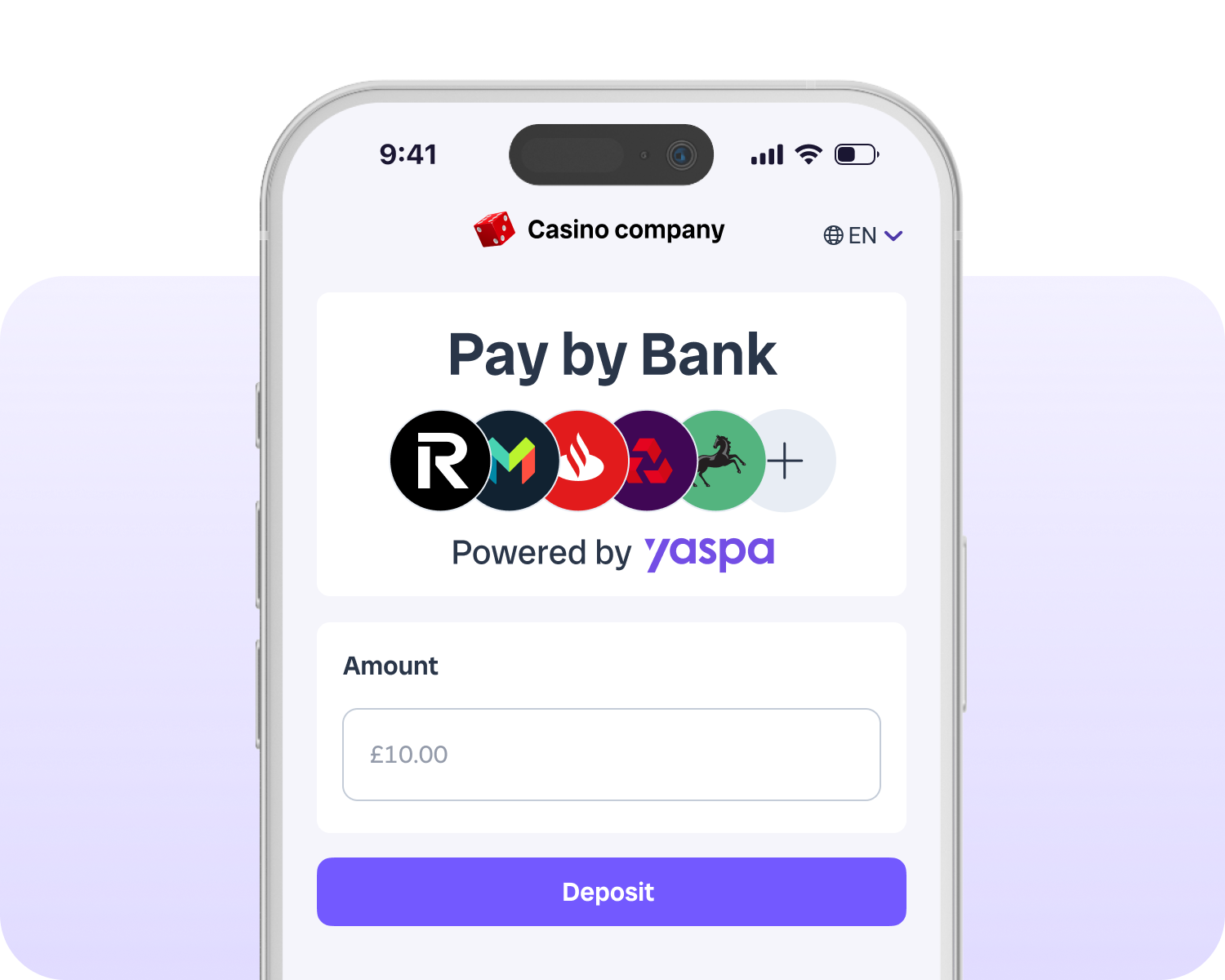

Fast, frictionless transactions

Pay by Bank from Yaspa uses open banking rails to speed up customer onboarding, reduce failure rates, and cut costs.

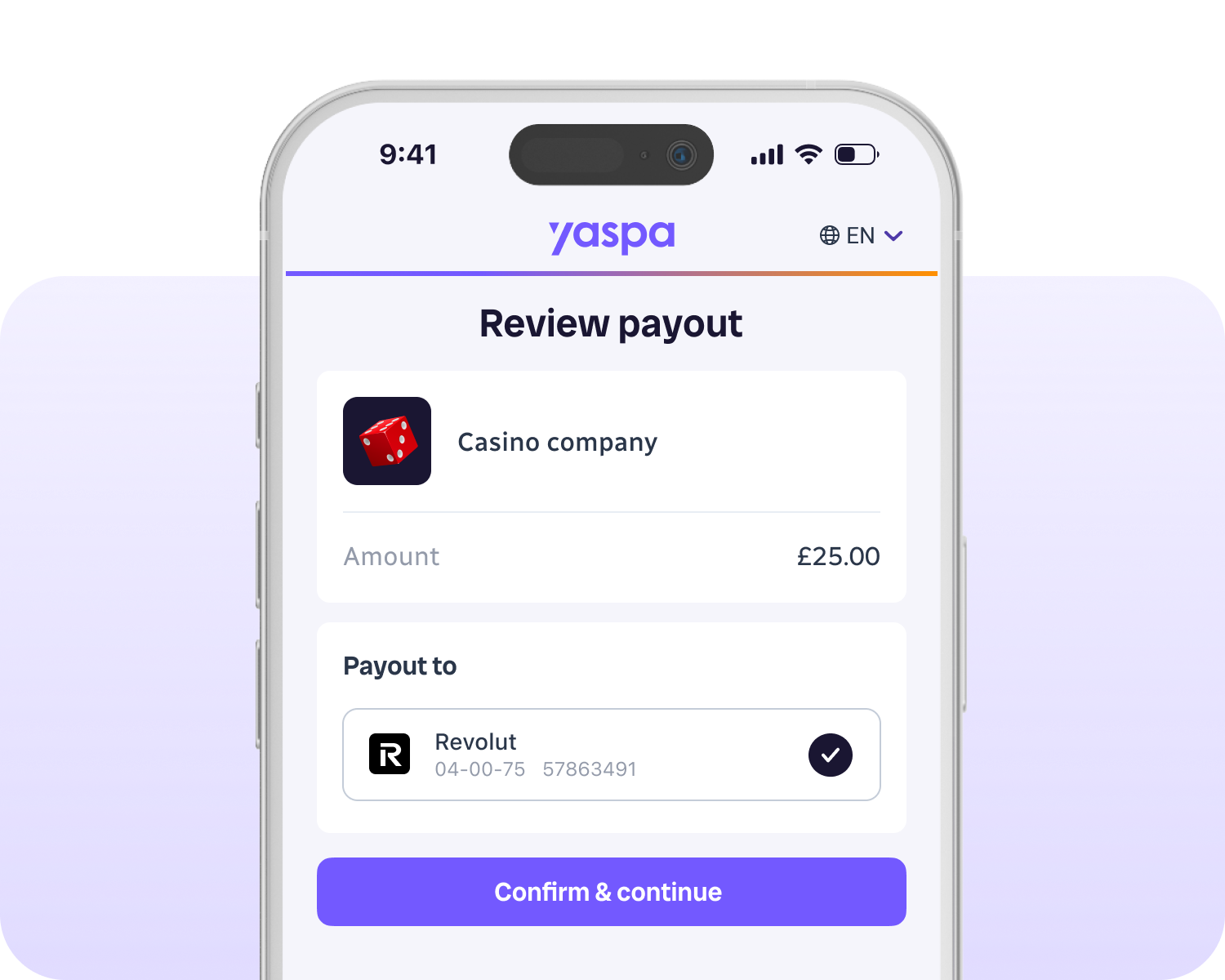

Withdrawals that don’t keep users waiting

From winnings to refunds, Yaspa powers real-time payouts – even cross-border – so funds arrive in moments, not days.

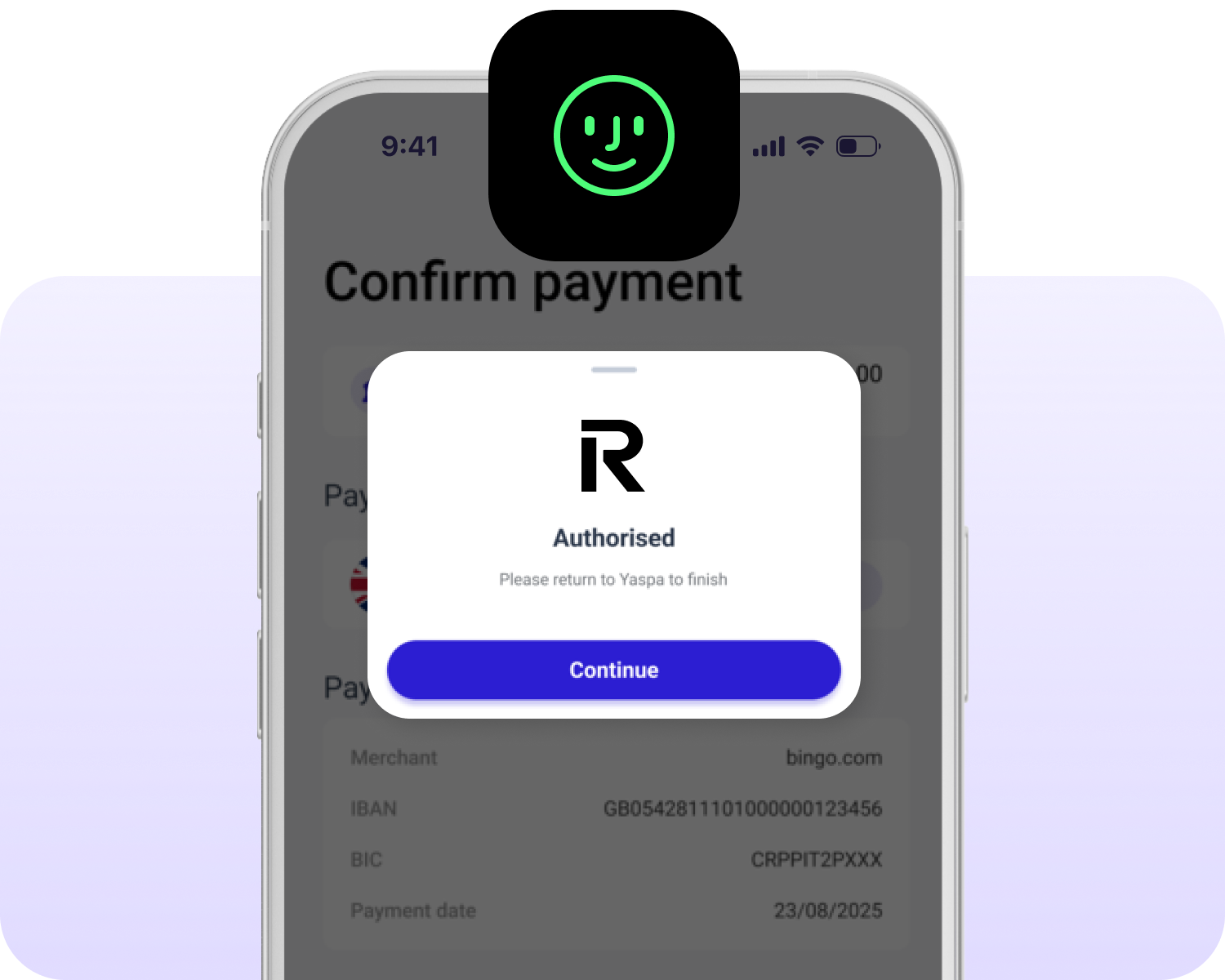

Verify who’s behind the payment – instantly

Bank-grade, biometric verification built in. Yaspa helps you stay compliant while keeping checkout seamless and secure.

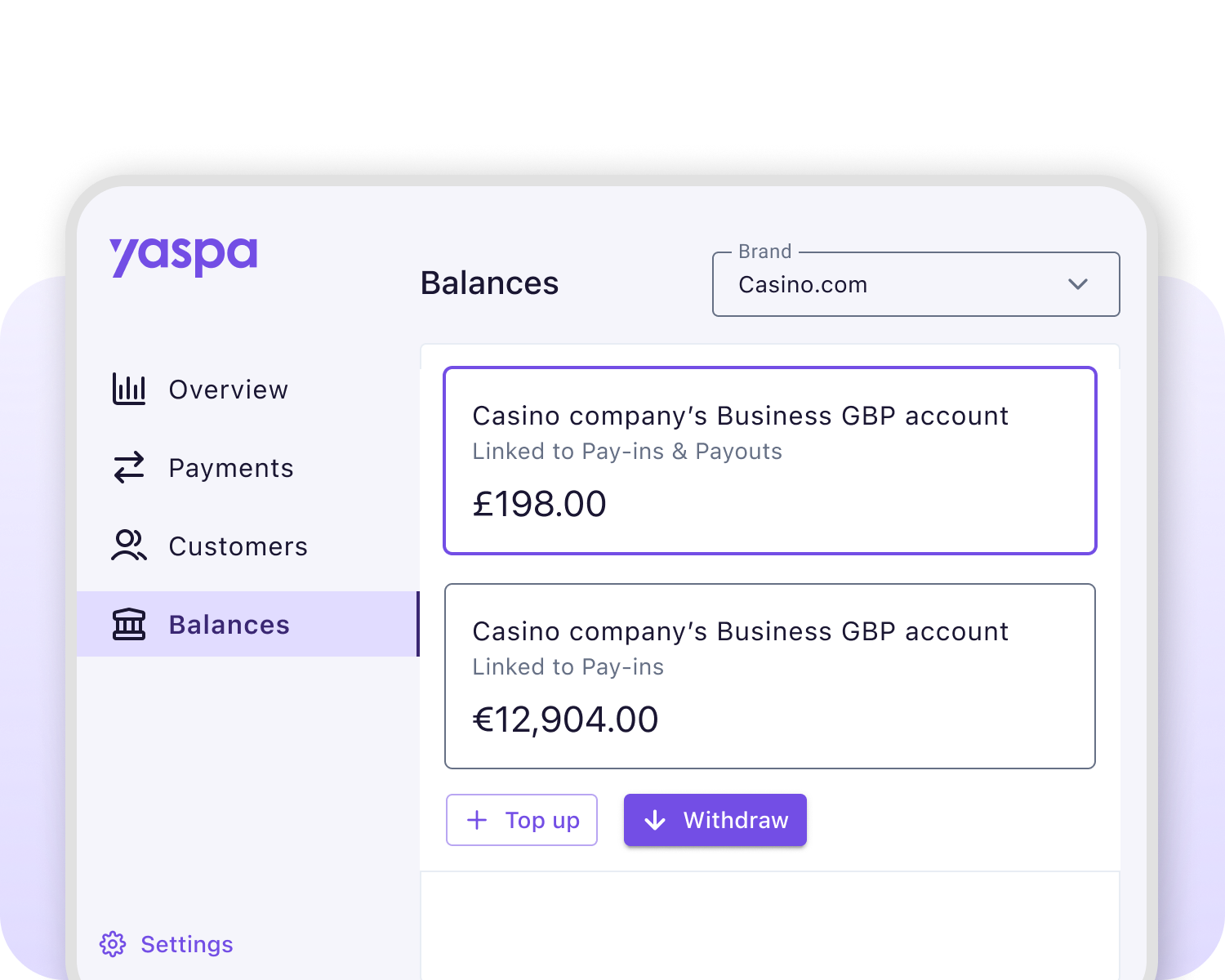

Track, split, or reconcile payments with precision

Issue unique IBANs in real time for each customer, partner or flow. Perfect for PSPs, affiliates and multi-brand platforms.

Get started