Subscribe

Stay in the know

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

At Yaspa we deploy a forensic approach to ensuring each and every user payment goes through to its destination as fast and securely as possible. With open banking standards deployed differently across the world, and with thousands of different banks and merchants set up in different ways, this forensic approach is vital to ensuring every customer making an open banking payment through Yaspa gets the experience we all want. Behind the scenes, this means payments successfully delivered, marked ‘Accepted’ and ‘Complete’, and the ability to immediately identify how and why any individual payments might have failed.

In March 2024, we launched our new International Organisation for Standardisation (ISO) status update feature designed to streamline the payment process for our merchants and their customers, and we’re delighted to say that it’s delivered a 100% success rate so far.

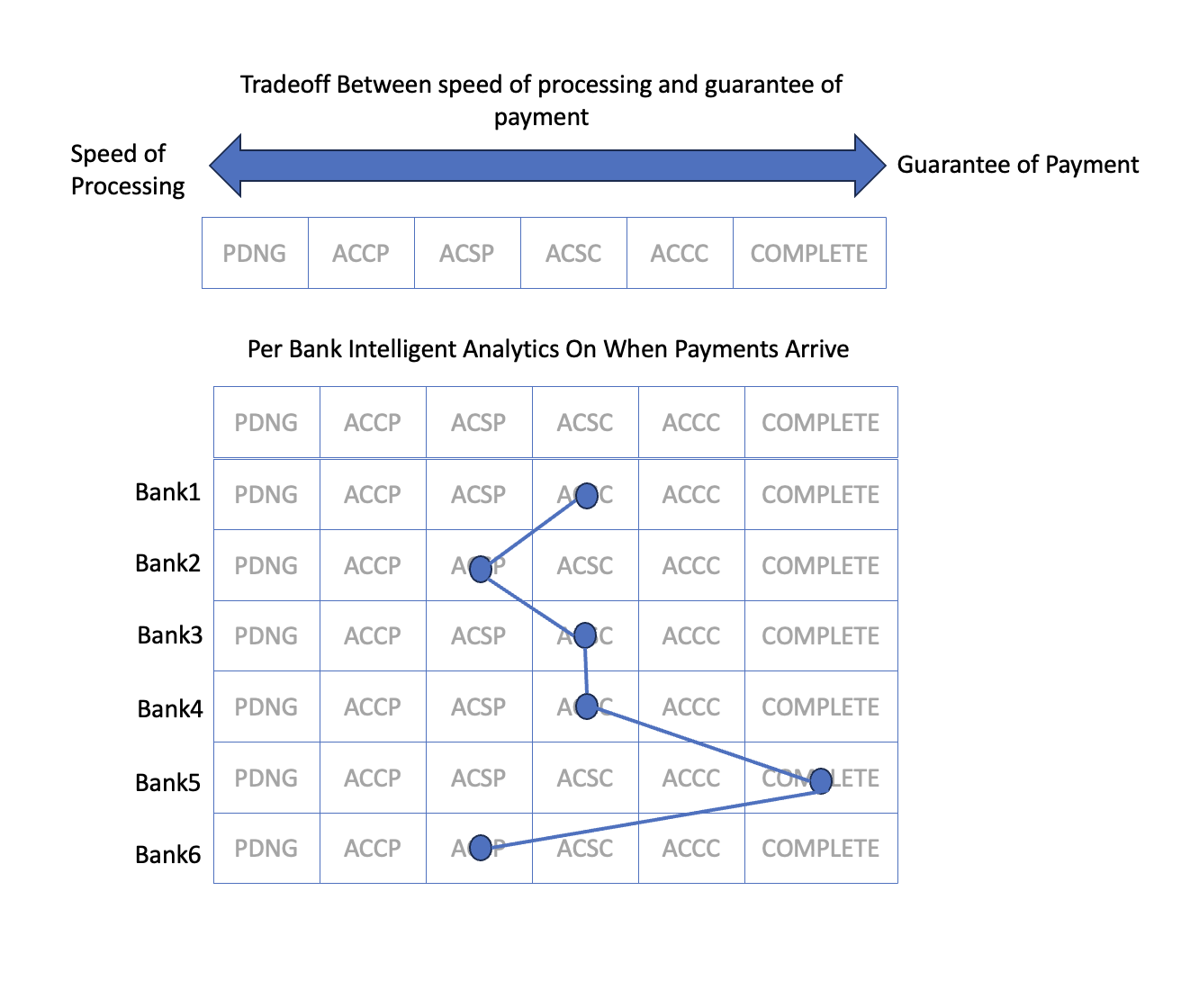

Assessment of the status of a payment at any single point in time is done through a series of payment status mechanisms used by banks, known as ISO codes. Currently, there is no universally accepted way in which banks manage ISO codes, meaning some banks may consider a payment vetted and accepted much earlier in the payment process than others. That means that merchants may be notified of a payment as being successful prematurely, releasing their goods and services to the payer, only to find at a later date that the payment process had not been fully completed.

This has security ramifications for merchants, who may issue goods or services to an account that may later be deemed by the bank to be fraudulent or have insufficient funds, leaving it open to abuse by fraudsters – a known problem in the iGaming industry – and is, generally, a time-consuming issue to diagnose and resolve, for everyone involved. The problem is compounded by the common use of third-party services, such as open banking API infrastructure platforms, for polling (repeatedly checking the status of a transaction to see if it has been completed or updated), despite them rarely being 100% accurate.

For Yaspa, being able to confidently deliver real-time payments to end-users is critical. So in March 2024, we ran a dedicated project to look at the issues around ‘payment notification polling’ and ‘payment status mapping’ to improve visibility – and peace of mind – of a payment’s outcome for our merchants and their customers. Effectively, after extensive research involving ISO code analysis, the use of Yaspa’s portal and data visualisation tool, Mixpanel, and a lot of spreadsheet work, we have built our own status notification system.

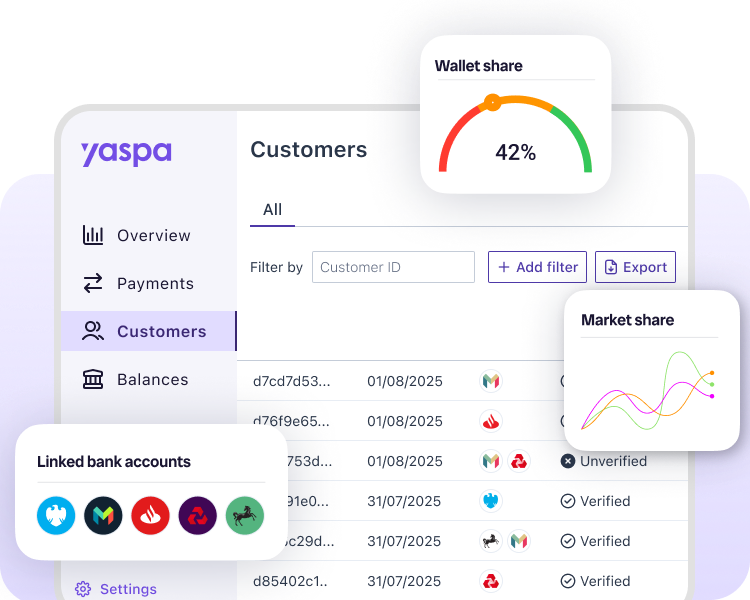

Now, we can monitor a transaction through a series of 15 possible statuses as it journeys from ‘Initiated’ to ‘Complete’, while using webhook notifications to inform our merchant customers of its outcome in real-time. Critically, it means that at Yaspa we can now make an accurate call on whether funds either have, or will, settle.

By bringing notifications in-house, we can monitor a transaction’s journey through the ISO codes in Mixpanel and our portal, and control when a payment outcome is sent to a merchant customer. To go a step further, we’re using our knowledge of the European bank networks to apply per-bank logic to this process. This allows Yaspa to decide what ISO codes constitute a payment outcome (i.e. an ‘Accepted’, ‘Cancelled’ or ‘Rejected’ webhook) based on the bank a person has paid with – this would not have been possible with a third party. For example, Revolut typically requires a transaction to pass through all 15 code stages before you can safely tell a merchant a payment will be ‘Accepted’. By creating a system that generates webhooks that are bespoke to each bank, Yaspa is reducing the risk of prematurely informing a merchant of payment acceptance.

Having insight into how each bank manages ISO codes means that we can also foresee if a payment will be accepted before funds have landed in a merchant’s account. Rather than rely on waiting for funds to settle, which can take minutes or even days, we use this foresight to provide merchants and their end-users with an instant payment outcome so goods and services can be released without delay – significantly improving customer experience by removing wait times – and fulfilling the promise of open banking payments that we are all championing.

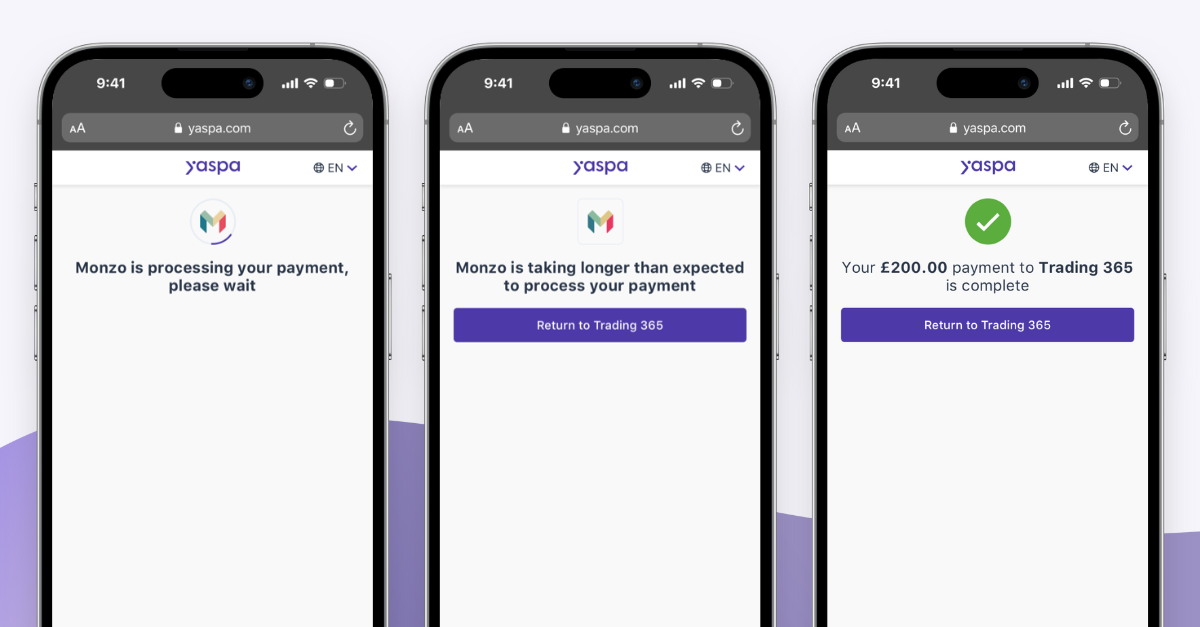

Simultaneously, end-users are guided through a series of wait screens within the payment journey while their payment outcome is generated to deliver improved clarity into their payment flow. However, if an outcome cannot be determined within 60 seconds, a user is automatically guided to a screen advising they inform the merchant, providing transparency without damaging user experience, as shown below:

The image below illustrates the ways different banks manage ISO codes to achieve an ‘Accepted’ payment outcome and why Yaspa’s per-bank logic is so important.

Yaspa’s latest update represents a significant improvement on how the industry currently operates, offering unparalleled security, transparency, and speed. Our merchants now experience a smoother payment flow, happier customers, and higher conversion rates.

Here’s a glimpse of what to expect:

Yaspa is proud to be one of few – possibly the only – open banking payment provider to handle payment statuses in-house. Yaspa prides itself on being a product-led, payments-first business, and we believe that ensuring our open banking payments truly deliver on the promises of speed, security and simplicity is a win, not just for us, but for the industry as a whole.

If this has interested you and you’d love to hear more about it, you can contact our team here.

Subscribe

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

"*" indicates required fields